Forex Brokers: Comprehensive Overview to Choosing a Broker

Forex Brokers: Comprehensive Overview to Choosing a Broker

Blog Article

Navigating the Complexities of Foreign Exchange Trading: Exactly How Brokers Can Aid You Keep Informed and Make Informed Choices

In the hectic world of foreign exchange trading, remaining informed and making educated choices is vital for success. By exploring the methods brokers offer market evaluation, understandings, threat administration techniques, and technical tools, investors can get a deeper understanding of exactly how to effectively utilize these resources to their benefit.

Function of Brokers in Foreign Exchange Trading

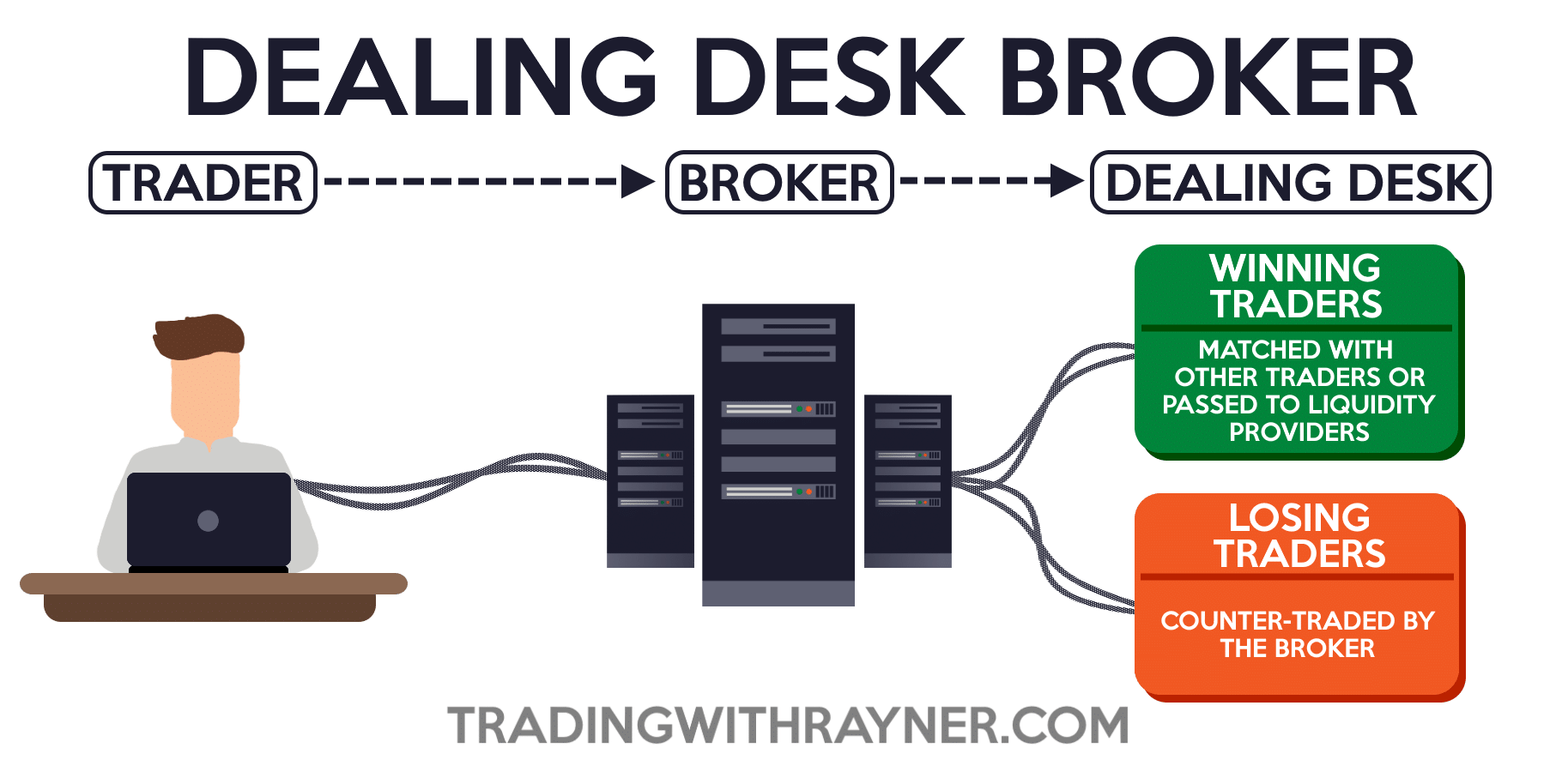

In the world of Forex trading, brokers play a crucial role as intermediaries helping with purchases between investors and the worldwide currency market. forex brokers. These monetary specialists function as a bridge, attaching individual traders with the complex and huge globe of foreign exchange. Brokers offer a system for investors to access the marketplace, offering tools, resources, and market insights to help in making educated trading decisions

One of the key features of brokers is to execute trades in behalf of their clients. With the broker's trading system, traders can sell and get money pairs in real-time, capitalizing on market variations. Furthermore, brokers supply take advantage of to investors, allowing them to manage larger placements with a smaller sized amount of funding. This attribute can enhance both earnings and losses, making danger monitoring a critical element of trading with brokers.

Moreover, brokers provide valuable educational sources and market evaluation to assist traders navigate the complexities of Foreign exchange trading. By remaining educated regarding market patterns, economic indicators, and geopolitical events, investors can make tactical decisions with the advice and assistance of their brokers.

Market Evaluation and Insights

Supplying a deep study market patterns and providing important insights, brokers gear up traders with the required tools to browse the complex landscape of Foreign exchange trading. Market evaluation is a critical aspect of Forex trading, as it involves analyzing different elements that can affect money price movements. Brokers play a pivotal duty in this by supplying traders with up-to-date market evaluation and insights based upon their know-how and research study.

Through technological analysis, brokers help investors understand historic rate data, identify patterns, and predict potential future rate motions. Additionally, basic evaluation enables brokers to evaluate financial signs, geopolitical events, and market information to analyze their influence on currency values. By manufacturing this information, brokers can supply investors valuable understandings into prospective trading opportunities and threats.

In addition, brokers typically provide market records, e-newsletters, and real-time updates to maintain investors informed regarding the most recent growths in the Foreign exchange market. This constant circulation of information makes it possible for traders to make knowledgeable choices and adapt their methods to changing market conditions. Generally, market evaluation and insights supplied by brokers are important tools that empower investors to navigate the vibrant globe of Foreign exchange trading effectively.

Threat Monitoring Techniques

Navigating the unpredictable terrain of Forex trading requires the application of robust risk monitoring methods. In the world of Forex, where market variations can occur in the blink of an eye, having a strong risk administration strategy is essential to guarding your investments. One vital strategy is establishing stop-loss orders a fantastic read to instantly close a trade when it gets to a certain undesirable rate, restricting prospective losses. Additionally, expanding your portfolio across different currency sets and asset classes can aid spread danger and shield against considerable losses from a solitary profession.

Remaining informed regarding global financial occasions and market news can help you prepare for prospective threats and change your trading strategies as necessary. Inevitably, a disciplined strategy to run the risk of management is essential for long-lasting success in Forex trading.

Leveraging Modern Technology for Trading

To effectively navigate the intricacies of Foreign exchange trading, utilizing sophisticated technical tools and platforms is necessary for optimizing trading strategies and decision-making processes. One of the crucial technical developments that have actually changed the Foreign exchange trading landscape is the development of trading platforms.

Moreover, algorithmic trading, additionally referred to as automated trading, has ended up being significantly prominent in the Foreign exchange market. By making use of formulas to examine market problems and perform trades automatically, investors can get rid of human emotions from the decision-making process and benefit from Discover More possibilities that develop within milliseconds.

Additionally, the use of mobile trading apps has empowered investors to stay attached to the marketplace whatsoever times, enabling them to check their settings, receive alerts, and area trades on the move. On the whole, leveraging innovation in Forex trading not just improves performance yet additionally offers investors with beneficial insights and tools to make educated choices in a very open market atmosphere.

Creating a Trading Strategy

Crafting a well-defined trading plan is crucial for Forex investors aiming to browse the intricacies of the market with precision and critical foresight. A trading strategy acts as a roadmap that details a trader's objectives, risk resistance, trading techniques, and strategy to decision-making. It assists investors maintain technique, manage emotions, and remain focused on their goals amidst the ever-changing dynamics of the Foreign exchange market.

Final Thought

In verdict, brokers play a vital function in aiding investors browse the complexities of foreign exchange trading by providing market analysis, understandings, risk monitoring strategies, and leveraging innovation for trading. Their knowledge and advice can assist traders in making notified choices and developing effective trading strategies. forex brokers. By collaborating with brokers, investors can remain informed and enhance their opportunities of success in the foreign exchange market

Report this page